We have excluded charge inside circumstances because they are usually varying, according to the bank

Nevertheless the larger question is… if you’re exclusively worried about expenses the mortgage of early to save towards the notice will set you back or have there been other ways in order to optimise the latest free dollars you may have?

And therefore goal is much more essential?

Regarding choosing Do i need to spend my personal financial otherwise can i purchase?’ the original part you ought to imagine was And that mission is much more crucial?’.

I understand that for a lot of they simply want comfort away from brain… being home loan 100 % free will definitely help make that happen.

There’s absolutely no denying one to repaying your property loan quickly often help reduce the total amount you spend to your notice, however it is not at all times a detrimental thing to maintain your own home loan because of its full-term if you lay those a lot more financing to a beneficial play with.

When you are calculated to amass wealth and you may safer your financial future, it will be practical doing some matter crunching. Expenses the bucks you’d provides used because most costs you’ll generate a distinction towards the complete budget.

Examine the fresh new data

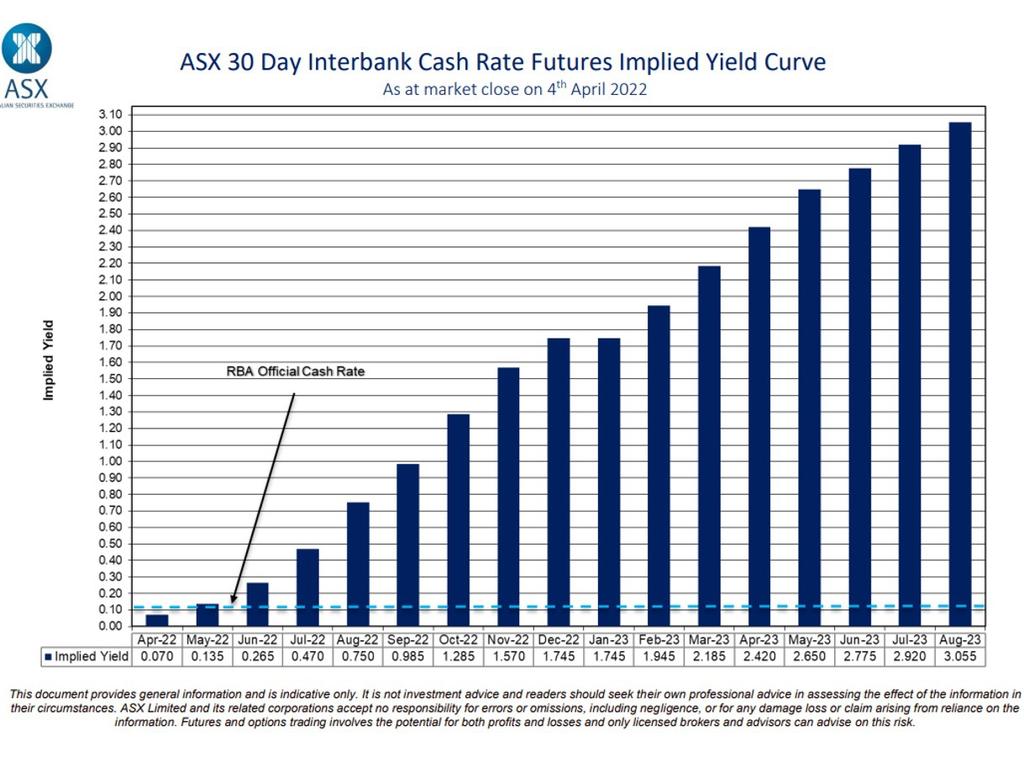

We currently are receiving a number of the lower interest rates actually seen along with the ongoing state of one’s Australian benefit, it’s likely that these types of low interest rates will stay for most time. This is where taking a look at the computations would be beneficial whenever ily.

Let’s grab the exemplory instance of a thirty season, $500,100 financial on a same day personal loan approval beneficial 3.5% interest rate. Most recent cost already are less than it however, i’ve used it getting illustrative objectives. Obviously, if the cost was indeed high otherwise lower over the 29 season period the fresh new rates do change. The fresh new Government’s Moneysmart on the web home loan calculator demonstrates that the new monthly costs on this subject financial is $dos,245.

After the newest 29 season term the home loan create be distributed and also you would have obtain $308,280 within the interest.

For many who paid back an additional $five-hundred each month, you would spend the money for home loan from from inside the 21 years and you may nine days and only shell out $214,168 total appeal more than 7 many years eventually and you can $94,112 less.

However,, if you had spent the new $500 each month, plus the average profits on return try 7.5%, compounding interest you may drastically improve the overall performance over the 31 seasons several months.

This new Government’s Moneysmart compound notice calculator demonstrates that forget the would be really worth $678,433 meanwhile your financial was finalised.

In this example there can be an astounding $584,321 difference in the degree of notice your stored on your home loan plus the investment you’ve got person.

Even if the rates of interest boost within the life of your financial, the brand new come back on your investment you will definitely remain the greater amount of amount.

Private factors

As calculations you will find simply outlined manage represent an optimistic analogy, you will find personal considerations to think about.

Almost everything comes down to what you are preferred that have. Whether or not you pay from your own mortgage or if you dedicate, each other can help you enhance your possessions.

Naturally, you should also think about your existence… while you are nearer to senior years then you might build various other choices to individuals within their early thirties.

Including, the limited tax price may also dictate your decision. Higher money earners will discover their financing money try taxed in the a higher rate, so paying their financial might possibly be a far more appropriate solution. A monetary agent can help you evaluate the choices and decide what is right for you.

Find the best price

In the long run, regardless of whether you opt to shell out your financial out-of very early otherwise spend money on the show field, it certainly is useful making certain you’ve got the welfare speed offered.

At Very first Monetary, our team off economic advisors can help you browse their pathway so you’re able to wide range. For those who have questions, please e mail us now. See several other financial investments article.